Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Tentrade is a popular broker in Africa and Asia that also offers proprietary services. In this review, I will be dishing out the pros and cons of Tentrade as a prop firm only.

Hardly can you see a prop firm that offers traders huge real capital to trade without passing through any evaluation challenges. And still charge a very low token as a fee to purchase these huge capitals. Tentrade really changed the game of prop firm industries, as they are the only prop firm so far that can offer instant funding with very low fees without any hidden charges.

Trading for a legitimate prop firm is the best and easiest way to become rich in the forex market. If trader A funds his account with $100 and makes 10% of the capital trading conservatively. The trader will end up with $10. But trader B uses $96 out of the $100 to purchase an account of $10,000 and makes 10% of the capital in a month. The trader will end up having $1,000. Have you seen that trading for a prop firm can make you richer than struggling with your small account.

In this article, I will be giving my honest review of Tentrade as one of the good and reliable prop firms.

Tentrade is a broker that acts as a third party between a trader and the forex market. It also offers a funding program that gives retail traders a huge amount of capital to trade with. And one peculiar feature that makes them stand out from other prop firms is that they offer traders real accounts, and traders don’t need to pass through any challenges. You purchase the real account at once and start trading.

Tentrade is a brand name of Evalanch Ltd. it is one of the best brokers that also offers other trading services like funding programs. This makes Tentrade a broker and also a prop firm. If you are looking for a prop firm that can fund you with huge real capital without passing through any evaluation challenges, then I recommend Tentrade.

Tentrade prop firm works by providing a huge trading capital for retail traders to trade with, with the motive of stepping up their trading career. Tentrade prop firm can be categorized into two (2)

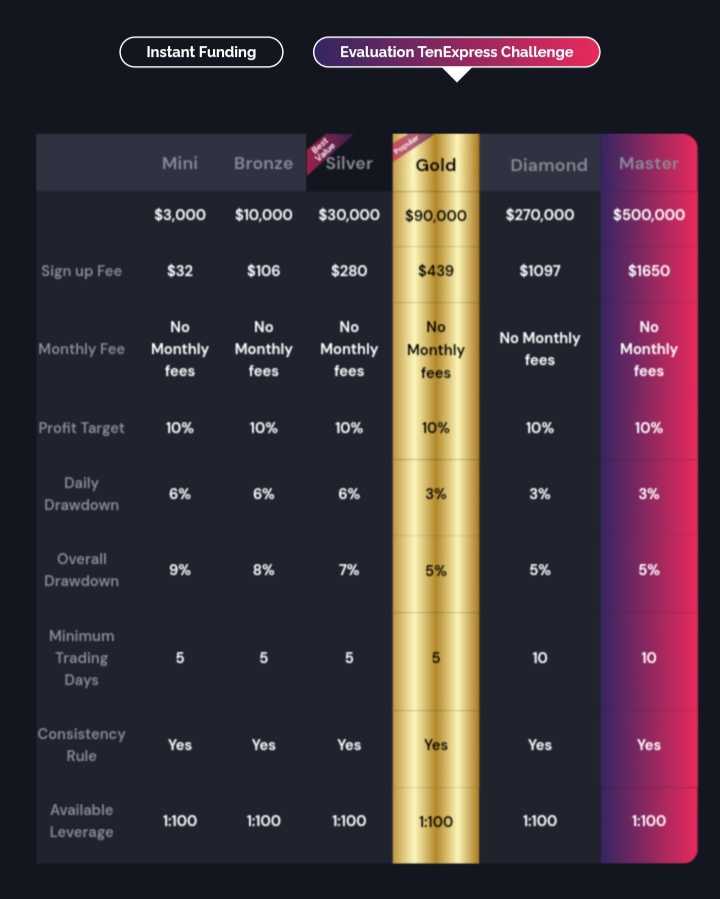

In Evaluation TenExpress, the features include

In monthly payout, you receive your withdrawals on monthly basis if you didn’t break any rules.

In accelerated payout, this is where you get payout once you get 10% of the capital given to you. No monthly basis. Once you get 10% of the capital, you can ask for withdrawals.

Unlike TenExpress, where you don’t need to pass any challenge before you get funded. All you need to do is purchase the account with a little fee and start trading instantly. Withdraw your profits once you hit your profit target. This is exactly where Tentrade changed the game. So far, I have not seen any prop firm that has the instant funding features that Tentrade has, especially their cheap price tags. These are the features of instant funding.

In monthly payments, you receive your withdrawals on a monthly basis.

In accelerated payout, this is where you get payout once you get 10% of the capital given to you. No monthly basis. Once you get 10% of the capital, you can ask for withdrawals.

For TenExpress Evaluation Challenge, the pricing includes:

$43 for $3,000

$110 for $10,000

$330 for $30,000

$990 for $90,000

$1097 for $270,000

$1650 for $500,000

For instant Funding, the pricing includes:

$100 for $3,000

$300 for $10,000

$900 for $30,000

$2,970 for $90,000

$5,500 for $270,000

$11,000 for $500,000

The rules in Tentrade vary according to the package you wish to purchase. Just as I have explained above, the rules in the TenExpress evaluation challenge are different from the rules in Instant Funding.

Yes, Tentrade prop firm is regulated. Tentrade is a broker and also a prop firm, Tentrade as a broker is regulated and licensed by the Seychelles Financial Service Authority.

Honestly, 70% profit split in TenExpress is poor; prop firms like FundedNext offer up to 90% profit split.

Instant Funding is the best to me as far as Tentrade Prop Firm is concerned. The features that Tentrade instant funding has, I don’t think any other prop firms have beat them so far, especially in the price tags.

FundedNext Review; is it legit?

Yes, the Tentrade prop firm is worth it. If you are looking for a prop firm that will fund you with a life account without passing through any evaluation challenges, I will recommend Tentrade for you.

Tentrade broker offers the best customer support. They are always ready to attend to complaints and work towards resolving them. You can reach them through phone calls, chats, emails, etc.

Tentrade is a multi-assets broker with multiple trading instruments like stocks, currency pairs, crypto, commodities, indices, etc. And one can trade all this assets on their Prop firm.

The Tentrade Consistency Rule helps to regulate traders’ risks as the trader makes profit from the prop firm.

For consistency rules, it is when you use conservative lot sizes on your trades. You can reduce your lot size to 50% from the starting lot size. And increased it as high as 200% from the starting lot size.

E.g., of a consistent lot size: 0.05, 0.05, 0.07, 0.08, 0.08, 0.09, 0.1, etc. If you pass your challenge using this pattern of consistent and conservative lot size, then you will have no issues during your withdrawals.

For inconsistency rules, this is when the lot size isn’t organized and it’s showing a high tendency of the trader trying to flip an account.

E.g., of an inconsistent lot size: 0.02, 0.01, 2, 0.01, 0.01 etc. If you pass an account with this kind of lot size, it shows that you used 2 lot’s size to flip and pass the account, then use the remaining lot’s size to fill up the remaining 5 trading days. If you use this kind of inconsistency lot size, Tentrade may give you some issues during your withdrawals.

Forex services offered by Tentrade can be accessed on some trading platforms, like TradingView and Metatrader5, for both mobile apps and web trading platforms.

If you pass the evaluation challenges, Tentrade will fund you with a real account. This account will be yours forever. You keep trading and making withdrawals from it.

If you breach the daily or maximum drawdown on your real funded account, Tentrade will take the account away from you. This will make you start again from purchasing and passing the evaluation challenge to be able to get funded. So go conservatively even when you have finally gotten your real funded account.

If you are unable to pass the evaluation challenge, the fee that you paid to purchase the account will not be refunded to you.

Yes, Tentrade is a legit broker that also offers a funded program. Tentrade fund traders with huge capital and pay within the average of 24 hours once a trader asks for withdrawal.

Yes, Tentrade Prop Firm is regulated, and Tentrade as a broker is regulated and licensed by the Seychelles Financial Service Authority.

Tentrade offers high security measures to ensure that its customers are always on a safer side. Tentrade always sends one a confirmatory email to confirm any action that is about to take place in one’s account. They ensure that customers always use a very strong password while opening an account with them. Also, customers’ funds are held in a segregated account in AA graded bank, using the highest level of protection.

It takes Tentrade 24 to 48 hours to review your account to either fund your real account or process your withdrawals.

The methods of depositing and withdrawing are simple and popular. These methods include card, online banking, crypto, Neteller, Skrill, PayPal, etc. It is very important to know that the method you used for depositing will be the same method you will use for your withdrawals.

Tentrade is a legitimate broker that also offers a proprietary firm. If you are looking for a prop firm that will fund your account with big capital without passing through evaluation challenges, then I will recommend Tentrade for you. Tentrade services are top-notch, and their features on instant funding make them stand out from other Prop firms. But if you want to go for a Prop firm with a higher profit split, you can check out my review on FundedNext.